reverse sales tax calculator quebec

Its great to have a reverse GST QST calculator because it will save you a lot of time when youre trying to figure out how much taxes you have spent on your purchase. On March 23 2017 the Saskatchewan PST as raised from.

Sales Tax Canada Calculator On The App Store

Up to 10 cash back Live Streaming The most reliable way to stream video.

. Here is how the total is calculated before sales tax. You have a total price with HST included and want to find out a price without Harmonized Sales Tax. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. That is a big difference. Amount without sales tax QST rate QST amount.

This app is brought to you by the creators of Hardbacon. Here is how the total is calculated before sales tax. Use our calculator to determine your tax or Reverse Quebecs cur Welcome to Calcul Taxes.

This means that some provinces and territories have a sales tax of as little as 5 while others reach 15. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Quebec applies 9975 QST and 5 GST to most purchases meaning a 14975 total sales tax rate.

Why A Reverse Sales Tax Calculator is Useful. To find the original price of an item you need this formula. Invest like a pro.

GST and QST apply to the price of the supply unless the supply is exempt or zero rated meaning taxable at 0. Reverse Sales Tax Formula. Calculating the sales taxes in the province of Quebec Canada.

In Quebec merchants have to pay GST and QST for all the sales madeCalculate you sales tax. The supply of a good or service including zero rated supplies is said to be a taxable supply if it is subject to the GST and QST and is made in the course of commercial activities. Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount.

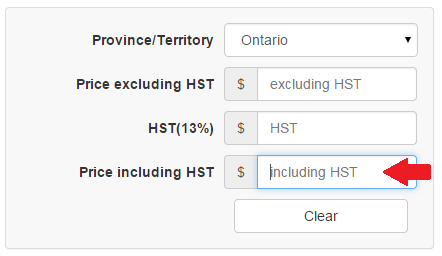

Enter that total price into Price including HST input box at the bottom of calculator and you will get excluding HST value and HST value. Amount without sales tax QST rate QST amount. Amount without sales tax GST rate GST amount.

Amount without sales tax GST rate GST amount. QST stands for Quebec Sales Tax. Price before Tax Total Price with Tax - Sales Tax.

Reverse Sales Tax Calculations. Amount without sales tax QST rate QST amount. Sales Tax Rate Sales Tax Percent 100.

In Quebec the provincial sales tax is known as Quebec sales tax. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Amount without sales tax GST rate GST amount. It is very good at doing one thing and one thing only. Calculating sales tax in Quebec is easy.

A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. OP with sales tax OP tax rate in decimal form 1.

Reverse GSTQST Calculator After Tax Amount. Current HST GST and PST rates table of 2022. Here is how the total is calculated before sales tax.

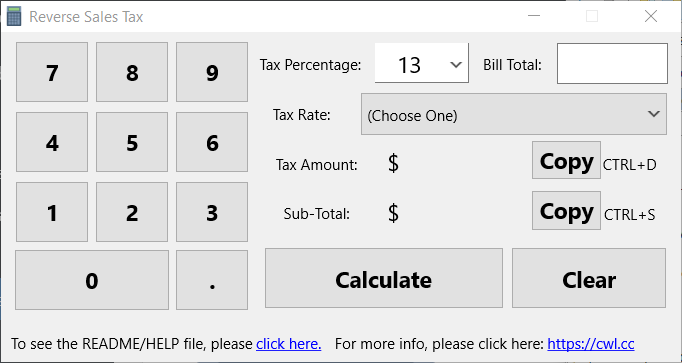

Calculates the canada reverse sales taxes HST GST and PST. Here is how the total is calculated before sales tax. Online calculator calculates Reverse Québec sales taxes - GST and QST 2020.

What taxes does Quebec apply. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. Amount before sales tax x GST rate100 GST amount.

This app is so easy to use youll never want to bother again using a calculator app to determine how much taxes youre going to pay on something. Why is QST 9975. Instead of using the reverse sales tax calculator you can compute this manually.

Amount without sales tax x QST rate100 QST amount. Amount without sales tax GST rate GST amount. All Harmonized Sales Tax calculators on this site can be used as well as reverse HST calculator.

The Quebec Sales Tax QST is simply the sales tax applied in the province of Quebec. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Amount without sales tax QST rate QST amount.

GSTQST Calculator Before Tax Amount. Amount without sales tax GST amount QST amount Total amount with sales taxes. This app is easy to use and fast.

There are times when you may want to find out the original price of the items youve purchased before tax. It is very easy to use it. 13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is.

Formula for calculating the GST and QST.

Reverse Hst Calculator Hstcalculator Ca

Canada Sales Tax Calculator By Tardent Apps Inc

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Canada Sales Tax Calculator On The App Store

Reverse Hst Calculator Hstcalculator Ca

Quebec Tax Calculator Gst Qst Apps On Google Play

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

Canada Sales Tax Calculator By Tardent Apps Inc

![]()

Quebec Sales Tax Calculator On The App Store

Calculate The Sales Taxes In Canada Gst Pst Hst For 2022 Credit Finance

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Quebec Tax Calculator Gst Qst Apps On Google Play

Quebec Tax Calculator Gst Qst Apps On Google Play

Pst Calculator Calculatorscanada Ca

Manitoba Gst Calculator Gstcalculator Ca

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca